Emma Ujah, Abuja Bureau Chief

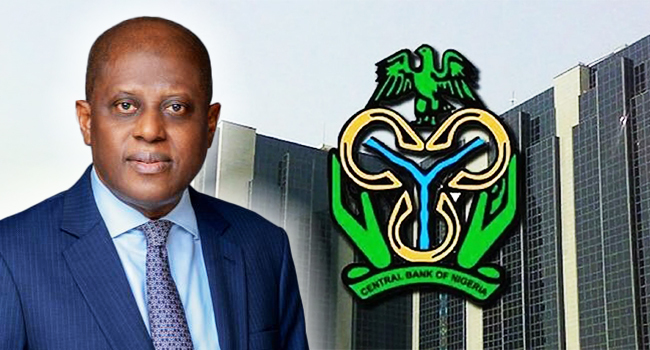

The Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, has rallied monetary authorities in the West African Sub-region against money laundry.

In an address at the 10th Meeting of the College of Supervisors for Non-Bank Financial Institutions (CSNBFI) in the West African Monetary Zone (WAMZ), in Abuja, this morning, he noted the growing trends in the Fintech space and its risks to financial stability globally.

According to the governor who was represented by the Ag. Director, Other Financial Institutions Department, Mr. Abayomi Arogundade, “We must continue to push forward the agenda of strengthening the anti-money laundering practices; deepening supervisory capacity on cybersecurity and Fintech regulation; and the implementation of risk-based supervisory approach.

“We reiterate the importance of monitoring trends, risks and innovations of NBFIs/OFIs as their increasing transaction volumes pose major financial system stability risk.”

On Fintech loans, the CBN boss said, “Fintech loans is one of the most commonly reported innovation. While overall this may appear small in relation to the size of credit by DMBs, some jurisdictions globally, have noted a growing trend in the volume of these loans.

“In many cases, Fintech credit is provided via electronic platforms that connect lenders to borrowers – in which case the platform takes the role of a financial auxiliary.

“In some cases, however, loans are taken on the balance sheet of these platforms (even if it is short-term), in which case the platforms are akin to new types of financial intermediaries. These entities are typically Fintech firms that offer applications, software, and other technologies to streamline mobile and online banking.”

He added that in many jurisdictions, digital firms had banking licences and are subject to prudential requirements or they may just be regulated as Fintech payment service firms and that innovations linked to crypto or Stablecoin assets were also reported by some jurisdictions.

Mr. Cardoso urged greater cooperation among regulatory bodies in the sub-region in order to address cases of exploiting innovations in the industry to hurt members of the public and institutions.

“Now, more than ever, the need for collaboration and cooperation amongst Member States cannot be overemphasized,” he said.

The governor described the Non-Bank Financial Institutions (NBFIs) or Other Financial Institutions (OFIs) sector, as an important component of the financial ecosystem and a key part of the strategy for the West African Monetary Zone (WAMZ)

The meeting of the CSNBFI Mr. Cardoso said, presented “a unique opportunity to move forward in our journey towards regional integration and shared economic prosperity in the context of ensuring both financial stability and the specialised financial intermediation the institutions are licensed to perform.”

He acknowledged the strides made by the CSNBFI, notably, the development of the Model Act for Non-Bank Financial Institutions and Non-Bank Financial Holding Companies of the West African Monetary Zone which was approved in March this year.

“Another important step by the College is the establishment of the Expert Committee on the Harmonisation of Supervisory Practices and Prudential Ratios of the NBFI Sector.

“While we celebrate the milestones that the CSNBFI has achieved, I implore you not to rest on your oars,” he said.

Also speaking, the Director-General of the West African Monetary Institute (WAMI), Dr. Olorunsola Olowofeso, noted the resilience of economies of member countries, despite the challenging global environment.

The meeting, he said, was very important as it presented delegates an opportunity to review developments in the non-bank financial institutions sub-sector within the Zone for the second half of 2023 and the first quarter of 2024, assess the regulatory and supervisory challenges of Member States and share experiences to mitigate emerging risks to the financial system of the WAMZ.

The D-G urged the experts to focus on identifying, assessing, and monitoring emerging risks, vulnerabilities, and early warning signals in the NBFI sector of the Member States and provide relevant recommendations to the Committee of Governors of the WAMZ.

According to Mr. Olowofeso, WAMI has achieved significant milestones in the implementation of two important projects: the Development of Domestic Debt Markets, Phase 1 and the West African Capital Markets Integration Program, Phase 2, aimed at developing debt and capital markets in The Gambia, Guinea, Liberia, and Sierra Leone.

He added, WAMI, in collaboration with the African Development Bank (AfDB), officially launched the Unique Bank Identity and Digital Interoperability (UBI/DI) Project in Conakry, Guinea on 26 June 2024 and recently received notification from AfDB on the proposal for the Implementation of Regional Digital Regulatory.

The outgoing Chairman of the College, Mr. Yaw Sapong, in his remarks said that in

the current economic landscape, the Sub-region faced several challenges, including inflationary pressures, currency fluctuations, and post-pandemic recovery efforts.

“These challenges,” he said “underscore the need for coordinated policy responses and enhanced regional cooperation to ensure economic stability and growth across the Sub-region.”

He urged greater dedication and collaboration among member countries in order to achieve a prosperous West Africa.

Disclaimer

Comments expressed here do not reflect the opinions of Vanguard newspapers or any employee thereof.